For millions of small businesses, freelancers, and independent contractors, the hardest part of a job isn’t delivering the work—it’s getting paid for it.

In an economy that prides itself on innovation, late payments remain one of its most persistent inefficiencies. Invoices drift past due, clients delay “processing,” and small business owners quietly become lenders without consent. According to a recent survey by the National Federation of Independent Business, 64% of small businesses report cash-flow challenges linked directly to unpaid or late invoices.

The problem isn’t just administrative. It’s structural.

The Trust Deficit in Small Business

Every late payment represents a small breach of trust. On one side, a contractor extends services in good faith. On the other, a client delays payment to protect liquidity. Between them sits an unpriced variable—trust—that determines whether commerce flows smoothly or stalls.

For years, fintech has promised solutions. Invoicing platforms automated billing; credit cards bridged gaps; factoring services monetized receivables at a premium. But the root cause—the erosion of confidence between buyer and seller—has gone largely unaddressed. What happens when both sides mean well, but the system itself assumes they won’t?

That question is driving the founding team at IOU, a U.S.-based startup developing what they describe as “the infrastructure of trust” for the modern economy.

Where IOU Fits In

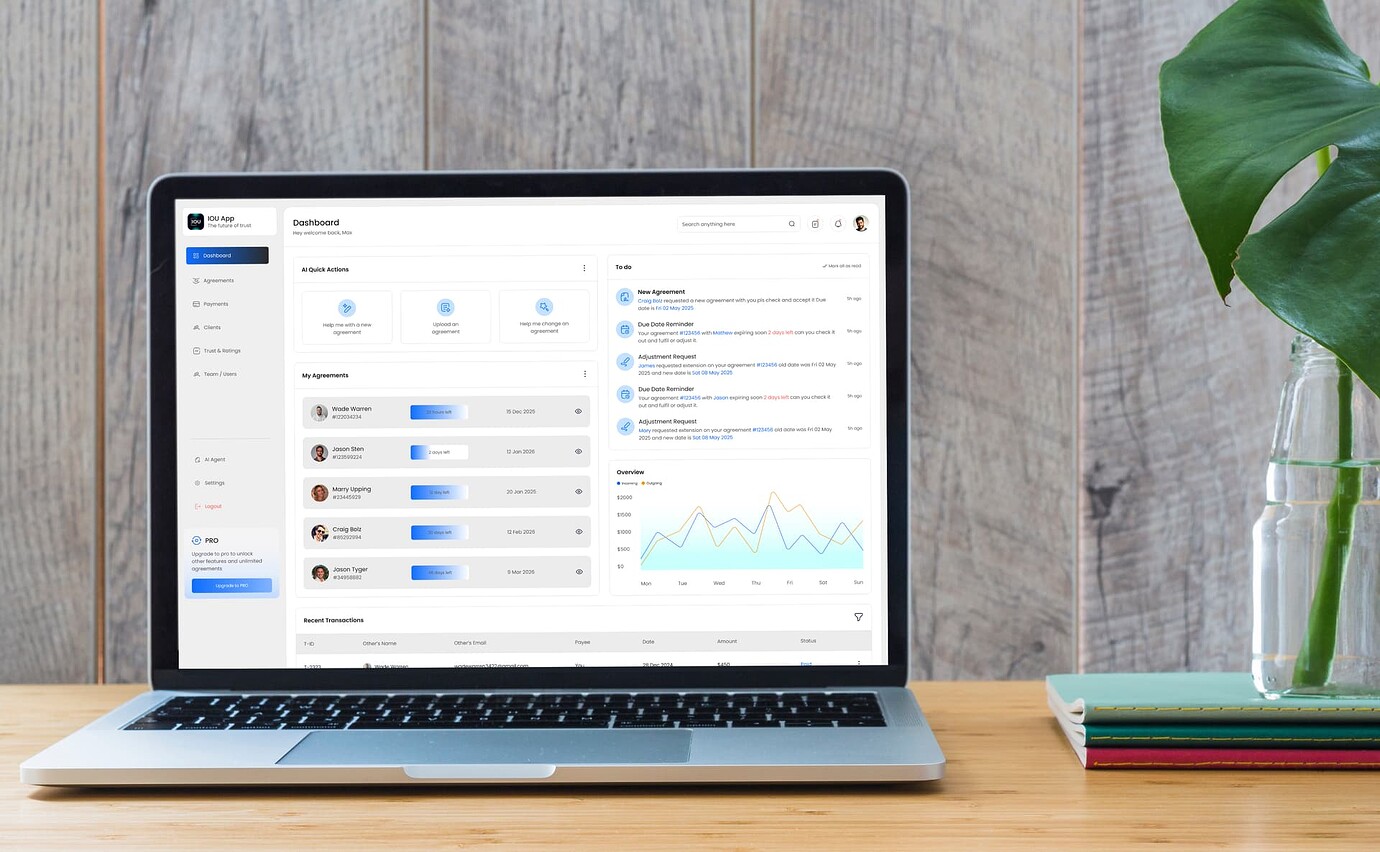

IOU’s concept is simple but radical: treat trust like capital. Its platform blends verified agreements, transparent payment histories, and AI-driven follow-up to reduce friction between those owed money and those owing it. Instead of chasing clients through emails or phone calls, vendors operate inside a digital environment that enforces social accountability.

“Everyone’s focused on moving money,” says Maximiliaan van Kuyk, IOU’s CEO and co-founder. “We’re focused on moving confidence. Once trust compounds, everything else accelerates.”

That idea sits at the center of IOU, a startup developing what it calls “the infrastructure of trust” for the modern economy.

Van Kuyk and co-founder Sauveur Atlan are veterans of the startup trenches. Their prior venture, connected creators and brands in the hospitality and dining sectors—a business that depended entirely on credibility and timely payment. The experience taught them how fragile informal trust can be, and how much it costs when it breaks.

The Unpriced Risk of Late Payments

For large companies, delays are a negotiation tactic. For smaller businesses, they’re existential. A 30-day delay on a $10,000 invoice can halt inventory purchases or payroll. Multiply that across industries—contracting, events, consulting, design—and the unpaid-invoice economy quietly rivals major lines of credit in size.

Yet this “trust economy” has no standardized rating system. FICO scores track borrowers. Yelp reviews track service quality. But there’s no portable, verifiable record of how consistently a business honors its financial commitments. IOU is betting that this missing layer is both measurable and monetizable.

Automation That Preserves Relationships

Unlike collections agencies, IOU doesn’t aim to escalate conflict. Its AI-powered reminders mimic human courtesy—consistent, contextual, and respectful. Rather than nagging, they nurture communication. The company calls it “follow-up that never gets tired,” designed to preserve relationships while moving money faster.

In a world increasingly skeptical of automation, IOU’s use of AI feels unusually humane. It doesn’t replace people; it removes the awkwardness that keeps them from speaking up. Over time, the data generated from these interactions could form a new kind of business reputation—one based on fulfillment, reliability, and timeliness.

The Macro Moment: Why Now

Three converging forces make IOU’s approach timely.

First, the freelance economy has gone mainstream. Nearly 40% of the U.S. workforce now participates in some form of independent work, according to McKinsey.

Second, AI is maturing into operational infrastructure, moving beyond chatbots to workflow automation that delivers measurable business outcomes.

And third, the human internet is shrinking. Between bots, scams, and deepfakes, trust in digital identities has eroded. In that environment, verified reputation becomes currency.

Investors Are Taking Notice

IOU’s early traction hasn’t gone unnoticed. The company is backed by Infinity Constellation VC, whose founder previously launched Invisible Technologies—an AI operations firm that competes with Scale AI. The fund’s bet is that IOU represents a new frontier in fintech: FinTrust—the convergence of finance, technology, and reputation.

What makes the opportunity so large is what makes it invisible. There’s no defined market cap for trust enforcement, yet every late payment is evidence of demand. IOU’s founders believe that as reputation becomes portable, a network effect will emerge: those who honor commitments will earn faster payments, better terms, and more opportunities.

From Payment App to Economic Signal

Zooming out, IOU’s long-term play isn’t just to move money faster—it’s to make good behavior visible. In doing so, it could redefine how risk is measured in the small-business economy.

If credit scores made lending scalable, and reviews made service quality transparent, IOU may do the same for reliability itself.

Late payments, it turns out, aren’t just an inconvenience. They’re a trillion-dollar signal that trust needs infrastructure.

And IOU is quietly building it.