In today’s hyperconnected digital landscape, the concept of trust has undergone a radical transformation. As cyber threats grow increasingly sophisticated, organizations have shifted from traditional security models to “Zero Trust” frameworks—where nothing is implicitly trusted, and verification is required from everyone. Yet in this environment of constant verification and inherent suspicion, blockchain technology has emerged as a paradoxical solution: a trust-building mechanism for trustless systems.

The Zero Trust Paradox

The Zero Trust security model, first introduced by analyst John Kindervag in 2010, represents a fundamental shift away from the castle-and-moat mentality that dominated cybersecurity for decades. Rather than assuming everything inside the corporate network is safe, Zero Trust operates on the principle that threats exist both outside and inside the network perimeter. “Never trust, always verify” is its mantra, requiring constant authentication and authorization for every user and system interaction.

While this approach has proven effective against many modern threats, it creates a challenging operational environment. Users face multiple authentication barriers, systems require continuous verification processes, and organizations struggle with balancing security and operational efficiency. The irony is palpable: in trying to protect against breaches of trust, Zero Trust frameworks can create environments where productive collaboration becomes difficult.

This is precisely where blockchain technology offers a compelling solution. By providing cryptographically secured, immutable records of transactions and interactions, blockchain creates verifiable trust in environments specifically designed to trust nothing.

Blockchain’s Trust Architecture

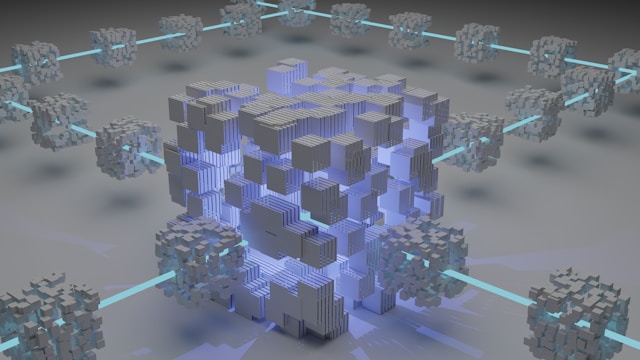

At its core, blockchain technology functions as a distributed ledger system that records transactions across multiple computers. Once information is recorded, it cannot be altered retroactively without altering subsequent blocks and achieving network consensus—a task that becomes exponentially more difficult as the chain grows longer.

These actions such as financial trades, ownership, messages inscriptions, and digitial identity, are all anonymous but instantly verifiable and trusted by the machine state.

For example, you can Google search, “Bitcoin ATM near me” but now Google KNOWS who is searching (you), your location, and your intent. Blockchain technology (Bitcoin) inherent properties creates a system where trust is built into the architecture itself, as opposed to being “granted to you” by Google or other tech giants.

In a Zero Trust environment, blockchain provides three critical trust elements:

First, it offers immutability—the assurance that records cannot be tampered with once created. This is particularly valuable in scenarios requiring audit trails, such as supply chain management or regulatory compliance. When every action is permanently recorded on a blockchain, accountability becomes automatic rather than enforced.

Second, blockchain provides transparency through its distributed nature. While private or permissioned blockchains can limit who sees what information, the underlying technology ensures that authorized participants have access to the same single source of truth. This transparency helps eliminate information asymmetry, a common source of trust issues in complex organizations.

Third, blockchain enables programmable trust through smart contracts—self-executing contracts with the terms directly written into code. These contracts automatically enforce agreements without requiring intermediaries, creating trustworthy processes even among parties with no prior relationship.

Practical Applications Emerging in 2025

As we navigate through 2025, several practical applications of blockchain within Zero Trust environments have moved beyond theoretical potential to deployed reality.

Identity verification remains one of the most compelling use cases. Decentralized identity systems built on blockchain allow users to control their personal data while providing cryptographic proof of identity attributes.

Rather than repeatedly sharing sensitive information with different services, users can selectively disclose only the necessary information while maintaining privacy. Major financial institutions have begun implementing these systems to reduce identity fraud while streamlining customer onboarding processes.

Supply chain management has similarly been transformed by blockchain’s ability to create transparent, verifiable records of product journeys. In pharmaceutical supply chains—where counterfeit medications can have life-threatening consequences—blockchain-based tracking systems now verify the authenticity of drugs at every step from manufacturer to patient. These systems operate on the Zero Trust principle of continuous verification but use blockchain to make this verification seamless and reliable.

Cross-organizational collaboration has also benefited significantly from blockchain implementation. When multiple organizations need to share sensitive information, traditional approaches often involve either placing excessive trust in a central authority or creating cumbersome verification processes. Blockchain-based collaboration platforms now enable secure information sharing with built-in accountability mechanisms, allowing competitors to become collaborators when necessary without compromising security principles.

Challenges at the Intersection

Despite its potential, the integration of blockchain within Zero Trust frameworks isn’t without challenges. The technology’s notorious energy consumption—particularly for proof-of-work systems like Bitcoin—remains a significant concern for environmentally conscious organizations. However, the emergence of more efficient consensus mechanisms like proof-of-stake has begun addressing these concerns.

Scalability represents another obstacle. Many blockchain implementations struggle with transaction throughput that falls short of requirements for enterprise-level applications. Layer-2 solutions and alternative blockchain architectures have made progress in this area, but further optimization is necessary for widespread adoption in Zero Trust environments.

Regulatory uncertainty adds another layer of complexity. As governments worldwide grapple with how to regulate blockchain technology, organizations implementing blockchain-based solutions must navigate an evolving compliance landscape. This is particularly challenging when these solutions cross international boundaries, each with its own regulatory approach.

The Human Element

Perhaps the most significant challenge lies not in the technology itself but in human adoption. Zero Trust security models already represent a cultural shift for many organizations accustomed to perimeter-based security. Adding blockchain technology requires further adaptation, both in terms of technical understanding and philosophical approach.

Security professionals must develop new skills to properly implement and maintain blockchain-based systems. End users need to understand the implications of immutable records and transparent processes. Leadership must recognize that blockchain isn’t simply another technology tool but a different way of conceptualizing trust relationships.

Organizations successfully integrating blockchain with Zero Trust approaches typically start with specific use cases where the benefits are most immediately apparent. As these initial implementations prove successful, the approach can gradually expand to other areas of operation. This incremental adoption allows for the necessary cultural shift to occur alongside the technological implementation.

Looking Forward

As we move deeper into 2025, the convergence of blockchain and Zero Trust principles will likely accelerate. Several trends are already emerging that suggest the direction of this evolution.

Interoperability between different blockchain systems is improving, allowing for more seamless integration into existing Zero Trust frameworks. This reduces the “walled garden” effect that previously limited blockchain adoption and creates more versatile trust mechanisms.

Artificial intelligence is increasingly being integrated with blockchain systems to create adaptive trust mechanisms—systems that can adjust verification requirements based on context while maintaining immutable records of these adjustments.

User experience is also receiving greater attention, with blockchain-based verification becoming progressively more invisible to end users. This is crucial for adoption, as security measures that create friction are often circumvented regardless of their theoretical effectiveness.

The New Trust Paradigm

The apparent contradiction between Zero Trust principles and blockchain’s trust-building capabilities resolves when we recognize that both represent responses to the same fundamental challenge: how to create reliable systems in an unreliable world.

Zero Trust acknowledges that traditional security boundaries have dissolved and that trust cannot be assumed based on network location. Blockchain acknowledges that centralized authorities bring vulnerabilities and inefficiencies to digital systems. Together, they create a new paradigm where trust is neither assumed nor absent, but rather continuously built through cryptographic verification and transparent processes.

In this new paradigm, we move from “trust nothing” to “verify everything verifiable”—a subtle but significant shift that maintains security while enabling collaboration. As blockchain technology continues maturing and Zero Trust frameworks become standard practice, their integration will likely become less remarkable and more expected—the natural evolution of how we establish trust in digital environments.

The organizations that thrive in this new landscape will be those that recognize blockchain not merely as a technological solution but as part of a broader reconsideration of how trust functions in the digital age. By embracing both the skepticism of Zero Trust and the cryptographic assurance of blockchain, they will build systems that are simultaneously more secure and more collaborative—the ultimate resolution of the trust paradox in our digital world.