One of the biggest challenges for landlords is verifying whether a tenant can afford the rent. Income verification used to be a time-consuming process. However, it has now become faster and more efficient with digital methods. In 2025, landlords are increasingly using digital income verification, eliminating the need for piles of paperwork. It enhances their assessment processes by providing instant and highly secure results. In this guide, LeaseRunner will explain what digital income verification means, how it works, and why it matters for landlords in the competitive market.

What is Digital Income Verification?

Digital verification of the income process for tenants and landlords

Digital income verification is the process of confirming a tenant’s earnings using secure online tools. Instead of waiting for printed documents, landlords can access the applicants’ electronic financial data, including recent pay stubs, bank statements, and tax returns.

The automated income verification delivers results within minutes. This makes it easier for landlords to make quick leasing decisions. It also reduces the risk of fraudulent documents.

Digital vs Traditional Income Verification Tools: Key Differences

The shift from traditional to automated income verification is a leap from a manual, paper-based system to a streamlined, secure one.

Traditional Methods:

- Manual & Slow: Involves collecting and reviewing paper documents, like pay stubs or bank statements.

- Prone to Fraud: Documents can be easily forged or manipulated, increasing the risk of choosing the wrong renters.

- Time-Consuming: The back-and-forth communication with applicants to gather documents can significantly delay the rental process.

Digital Methods:

- Instant & Secure: The income verification process online takes minutes, not days. The data comes directly from a verified source, eliminating the risk of fraud.

- More Accurate: Provides a comprehensive view of an applicant’s income over a specific period, including regular deposits and cash flow.

- Efficient: The entire process is automated, freeing up your time to focus on other aspects of property management.

How Landlords Conduct the Online Income Verification Process

Step-by-step digital income verification process online for landlords

Adopting an income verification process online is straightforward if you follow the right steps.

Step 1 – Ask for Tenant Authorization and Consent

The first and most crucial step is obtaining the applicant’s explicit consent. Before landlords access the applicants’ personal data, they must agree to the income check. This is not only a matter of transparency but also a legal requirement under regulations like the Fair Credit Reporting Act (FCRA).

Step 2 – Conduct Secure Income Check with Payroll or Bank Data

Once authorized, the digital platform sends a secure link to the applicant. The applicant then uses this link to log into their payroll account (e.g., ADP, Paychex) or bank account. The platform does not store or see their login credentials. It simply retrieves and analyzes the necessary data in a read-only format, fully compliant with GDPR, FCRA, and tenant privacy standards.

Step 3 – Receive Real-Time Income Verification Results

Within minutes, landlords receive verified reports showing gross income, employer details, and payment consistency. This efficiency speeds up leasing decisions.

Cases of Digital Income Verification

Digital income verification is applicable in many situations. They include digital income verification for loans and rentals. Whether used directly or indirectly, this tool provides landlords with quick and accurate outcomes. These solid grounds boost their confidence in making the leasing decisions.

Rental Market Applications for Landlords

Digital income verification aims to check if tenants meet landlords’ minimum income requirements and have stable income sources. This prevents landlords from facing late-payment cases and defaults. In fact, many property owners have cut tenant placement processing times from weeks to days by implementing AI-driven automated income verification.

Loan & Mortgage Income Verification Online

The landlords also use the loan and mortgage income verification online to verify the applicant’s rent affordability. This process paints them a clear picture of their current financial status. The owners will be aware of their debts or mortgages.

Common Types of Proof of Income Landlords Should Know

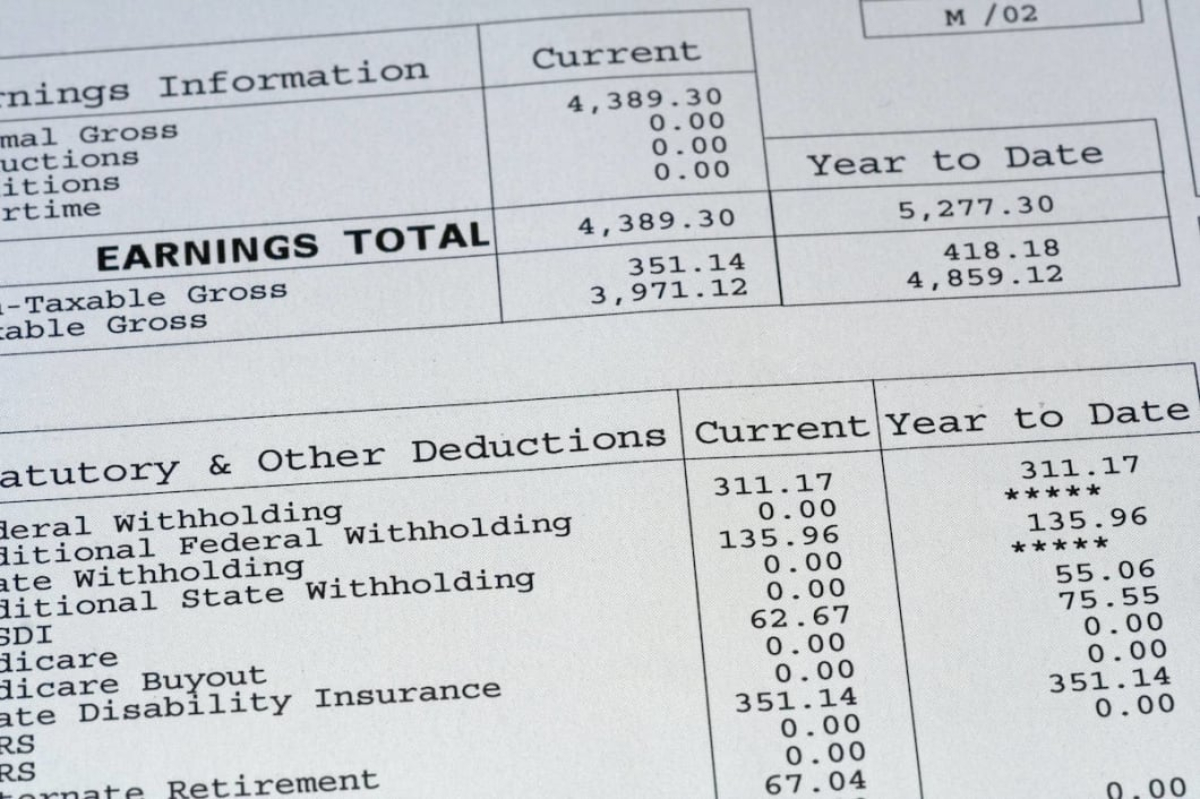

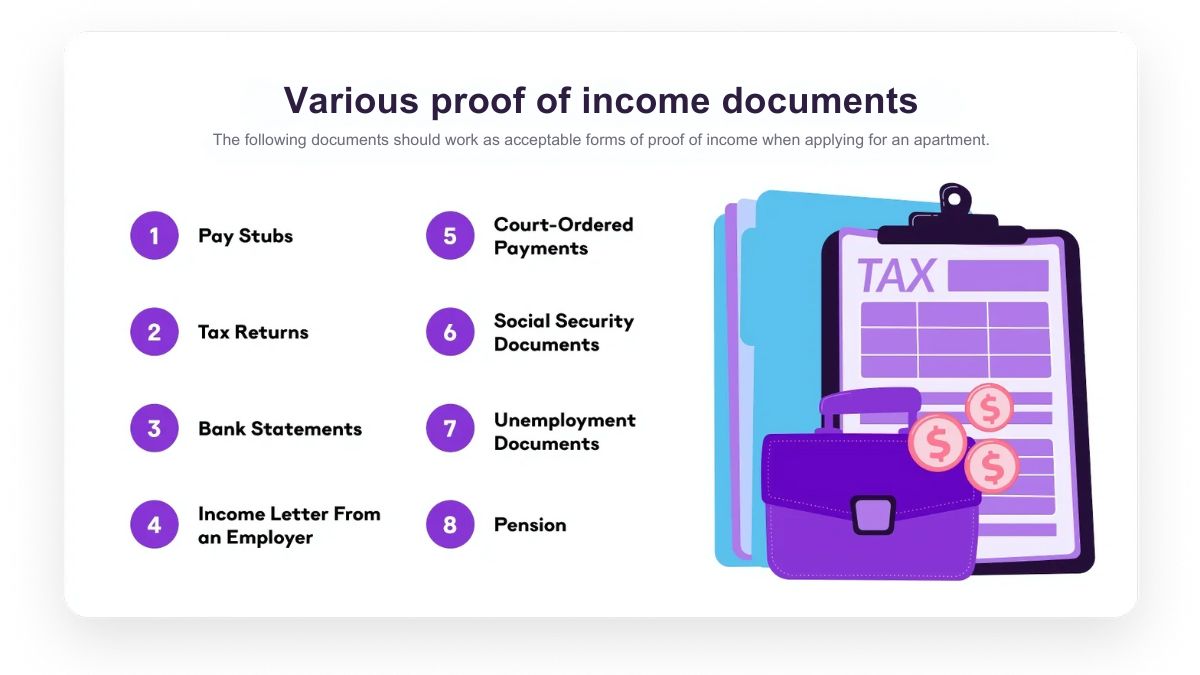

Various proof of income documents

Even with digital tools, it’s important to recognize standard proof of income documents:

- Paystubs: These are one of the most common forms of proof, showing an applicant’s gross pay, deductions, and net pay for a specific period.

- Bank Statements: These can reveal a person’s spending habits and cash flow, reflecting a steady income.

- Tax Returns: Often used for freelancers or self-employed individuals, tax returns provide a detailed look at an applicant’s income over a full year.

- Offer Letters or Employment Contracts: While these can confirm a job and salary, they don’t guarantee that the person is still employed or is earning the stated income. For more information, you can read our guide on how to write a proof of income letter.

- Social Security or Pension Benefit Letters: For retirees, these letters confirm their monthly fixed income.

- Unemployment or Government Assistance Statements: These documents prove a steady, if temporary, source of income from a government agency.

Best Practices for Landlords Using Digital Income Verification Tools

To use digital income verification effectively, it’s crucial to follow a few best practices.

Set a Clear Income Requirement

Before you begin screening, establish a clear rule, such as requiring tenants to have an income that is at least 3 times the monthly rent.

Choose Reliable Digital Platforms

Income verification requires accuracy and security. Landlords have to select a reliable digital tenant screening service, such as LeaseRunner. It generates online income verification and cash flow reports within minutes. The tool maintains the tenants’ data privacy and ensures the landlords’ compliance with landlord-tenant regulations.

Always Cross-Check with ID Verification

While income is a key factor, it’s not the only one. Always verify the applicant’s identity with a government-issued ID to ensure the person applying is who they say they are.

Maintain Transparency with Tenants About Data Use

Be upfront with your applicants about how their data will be used. Explain that the income verification process online is a secure method to protect both their identity and your property.

Combine with Tenant Screening Reports

A complete picture is key. Always use income verification in conjunction with other essential tenant screening reports. This includes checking for credit, eviction, and criminal history to get a full view of the applicant’s suitability.

Landlords’ Concerns When Using Digital Income Verification Tools

Common landlord concerns about using digital income verification

While a powerful tool, it’s fair for landlords to have some concerns.

Data Privacy and Security Risks

Data breaches are a valid concern. Landlords must ensure platforms use encryption and follow compliance laws to protect tenant data.

Challenges of Screening Tenants without Digital Records

What about an applicant who works as a cash worker or a freelancer and doesn’t have a traditional payroll? This is a valid limitation of digital tools. In these cases, you may need to supplement the process by manually requesting bank statements or tax returns.

Costs of Using Those Digital Platforms

The digital income verification services are affordable. Using these tenant screening methods helps landlords save a lot of money. This makes their property investment even more worthwhile.

Conclusions

Verifying tenants’ financial stability is no longer complicated in 2025. Digital income verification speeds up the tenant approval process, reduces fraud, and ensures more accurate screening. While there are challenges, especially for tenants without digital records, the benefits far outweigh the drawbacks.

By adopting automated income verification, landlords can make smarter and safer rental decisions.

FAQs

1. How long does digital income verification take?

The entire process, from the tenant’s authorization to you receiving the report, usually takes only a few minutes. This is why it’s also known as real-time income verification.

2. Is online income verification secure?

Yes, when using trusted providers that follow GDPR and FCRA standards.

3. Do tenants need to share documents?

Not always. Many platforms pull income directly from payroll or bank systems.

4. What if my tenant doesn’t have digital payroll records?

You can still request traditional documents like pay stubs or tax returns.

5. Can digital verification be used for mortgages?

Yes. Banks and landlords alike use mortgage income verification online tools for accuracy and speed.